The investment strategy brief on unique identifiers 944079985, 692110160, 22001577, 3033262500, 63030604659819, and 8883237625 presents a systematic approach to asset management. These identifiers facilitate improved transaction transparency and effective data retrieval. Furthermore, the analysis of market trends and asset performance can reveal significant growth opportunities. Understanding these elements is crucial for developing robust strategies aimed at enhancing portfolio performance and achieving long-term financial objectives. What insights will emerge from this analysis?

Overview of Unique Identifiers

Unique identifiers serve as critical tools in the realm of investment strategy, enabling precise tracking and management of assets across various platforms.

Their significance lies in facilitating efficient data retrieval and enhancing transparency in transactions. Identifier categorization further aids investors in organizing assets, ensuring that each investment can be distinctly monitored.

This structured approach promotes informed decision-making, essential for achieving financial autonomy and growth.

Market Trends and Analysis

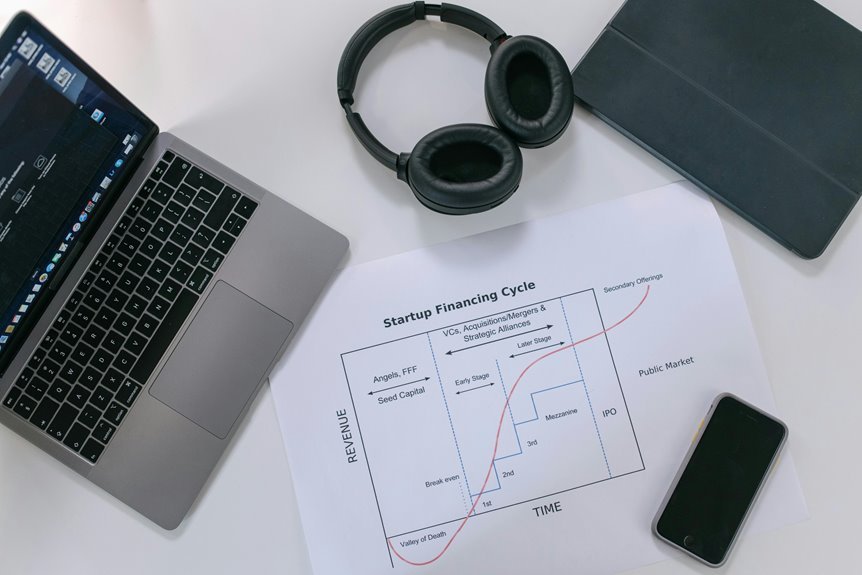

Market trends and analysis play a pivotal role in shaping investment strategies, as they provide insights into the dynamics of financial markets and the broader economic landscape.

Understanding market dynamics is essential for generating accurate investment forecasts, enabling investors to navigate fluctuations and identify opportunities.

Asset Performance Insights

Although various factors can influence the performance of assets, a thorough analysis of historical data and current market conditions reveals significant patterns that can inform investment decisions.

Effective asset allocation strategies, coupled with comprehensive risk assessments, provide insights into potential returns and volatility. Understanding these dynamics equips investors with the knowledge to navigate market fluctuations while pursuing their financial objectives with confidence.

Growth Opportunities and Strategies

As investors seek to capitalize on emerging trends and innovations, identifying growth opportunities becomes paramount for portfolio enhancement.

Focusing on emerging markets and sustainable investments allows for diversification and potential high returns.

Rigorous risk assessment is essential to navigate volatility, while value investing strategies can uncover undervalued assets.

This balanced approach fosters resilience and positions portfolios for long-term growth in evolving economic landscapes.

Conclusion

In summary, the strategic significance of unique identifiers in asset management cannot be overstated. By facilitating focused financial frameworks, these identifiers foster transparency, bolster transaction tracking, and illuminate investment insights. As market dynamics evolve, investors are urged to harness these tools to navigate the nuanced landscape of growth opportunities. Ultimately, a meticulous approach to monitoring market movements, paired with robust performance metrics, will ensure sustained success and stability in the ever-changing investment arena.